TRENDS AND EVOLUTION OF CLEANTECH IN FLANDERS

Financial performance

Financial performance

The statement that 2020 will be a year for the history books is no exaggeration. The COVID-19 pandemic has had a profound impact on the world’s economy. The Belgian GDP shrank by 5.7% in 2020 (year-on-year), which dwarfs the decline experienced during the Great Recession of 2009 (-2% of GDP).

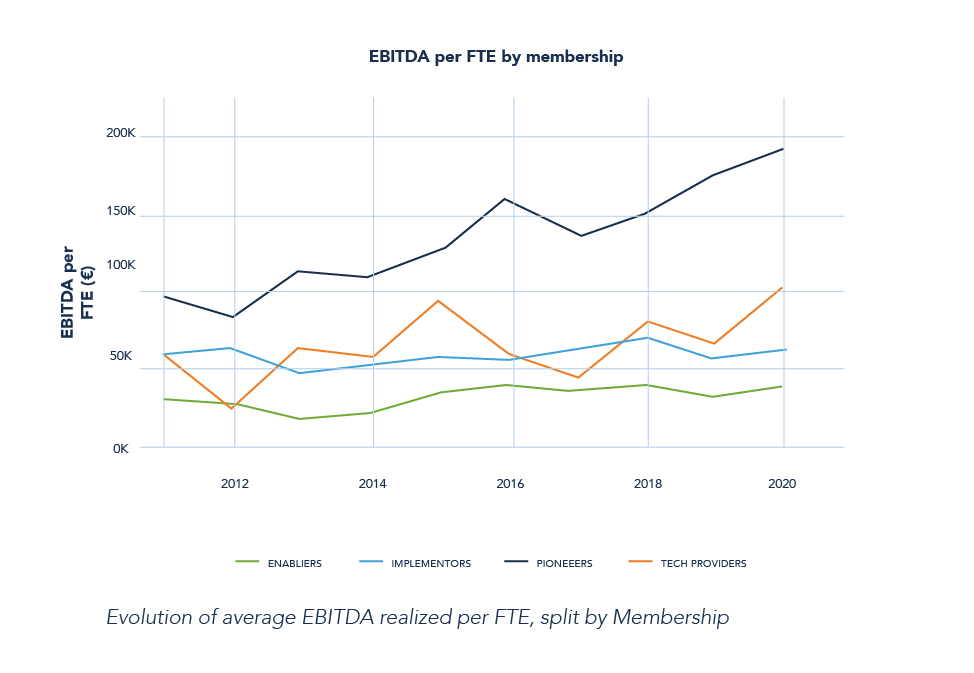

Framed within this context, it is notable to observe not only an increase of number of registered companies in the cleantech sector, but also a statistically relevant increase in both total EBITDA growth (+26,61% YoY) and average EBITDA growth per actor (+21,87% YoY), bucking the downward trend seen in the previous report for the data of 2019. It also lends additional credibility to

the statements issued during the 2020 pandemic that businesses with a focus on sustainability were better positioned to deal with the crisis.

The impact of fluctuations in annual financial reporting caused by large tech providers and pioneers was a critical factor observed throughout the decade. And it is a factor worthwhile to consider given the exceptional performance of the sector versus the overall economy.

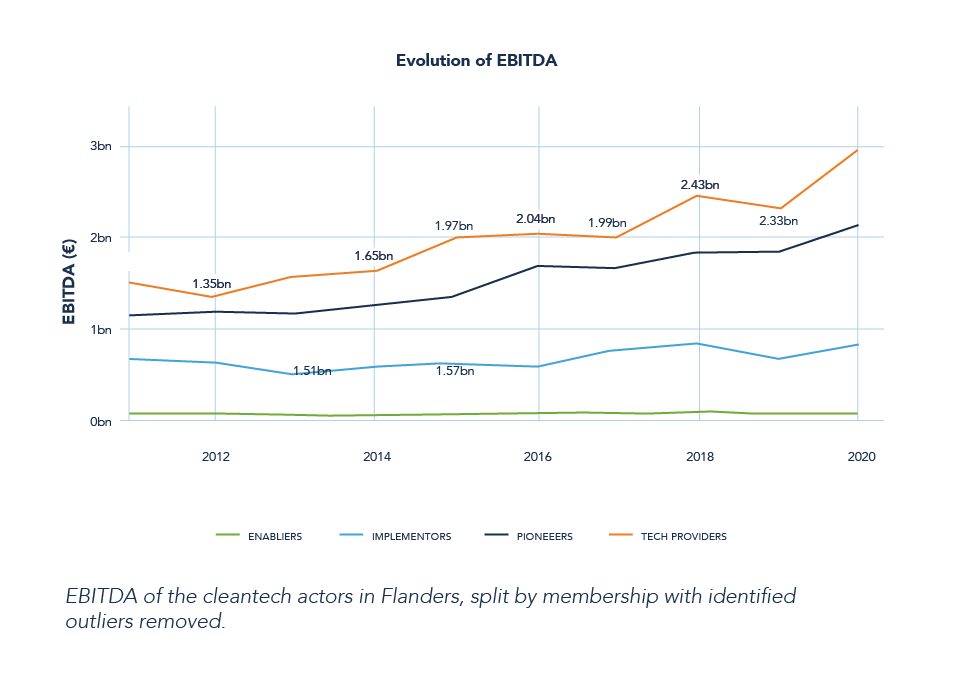

The evolution of EBITDA over the past decade has shown a steady increase, despite significant year-to-year fluctuations. A closer look at the data attributes the source of these fluctuations within the financial reporting of large tech providers. Large acquisitions, investments, or the sale of a subsidiary in a select number of companies can skew the data. Implementors or pioneers realized more stable and significant growth throughout the past decade, continuing to prove that there is a market demand for cleantech.

Another trend which changed in 2020 was the Intangible assets held by the cleantech sector. The term is nebulous at best but is typically considered to be a metric closely associated with investments in R&D, innovation, and patents held. This asset class has been on the decline since 2013. In 2020 it bounced back to near record levels. All membership types expanded their intangible assets, but notably the Enablers hold a negligible amount compared to the rest of the sector. This is not unsurprising, as enablers typically facilitate the adoption of technologies by other actors, not develop them.